03 - Utility Demand function and Pricing - DME

03 - Utility Demand function and Pricing - DME

%%

[[2024-11-08]]

%%

In the following discussion, we will assume the costumer to be economically rational:

The costumer will always try to maximize:

- Consumption

- Utililazation

Utility function

Let

For simplicity, in this chapter we will work with only 2 goods:

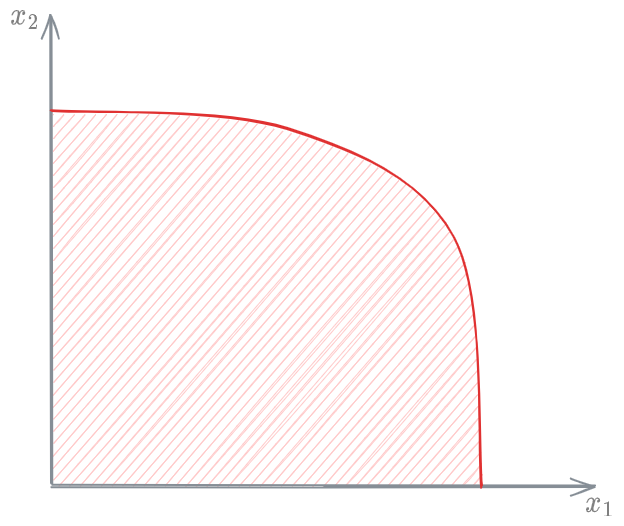

We can visualize this in the following graph:

The area under the graph is the set of all possible combination of

The utility function is defined as follows:

The utility function, is a function

such that

It's a particular function. We are not as much interested in the absolute value of the function as much as we are in the relative value. We don't really care how much

Properties of the utility function

The #Utility function is continuous

The #Utility function is monotonically increasing on every single variable:

The second derivative exists and is always negative or equal to 0 (the function is cuasi-convex):

The #Utility function, calculated in the empty set (in

Types of utility function

Cobb-Douglas utility function

The Cobb-Douglas utility function has the following value:

where

are positive coefficients that measure the consumer preferences.

Quasilinear utility function

The Quasilinear utility function has the following expression:

where:

or

Linear utility function

The linear #Utility function is works well for [[#Perfectly substitutive goods]]:

where:

Other utility function

The other #Utility function works well for [[#Perfectly complementary goods]].

where:

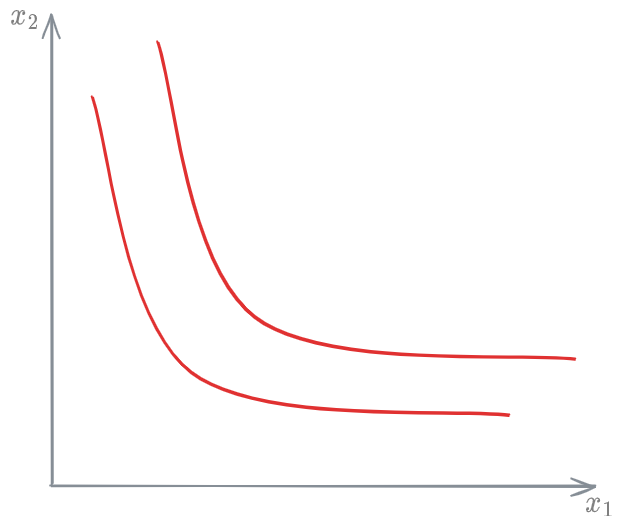

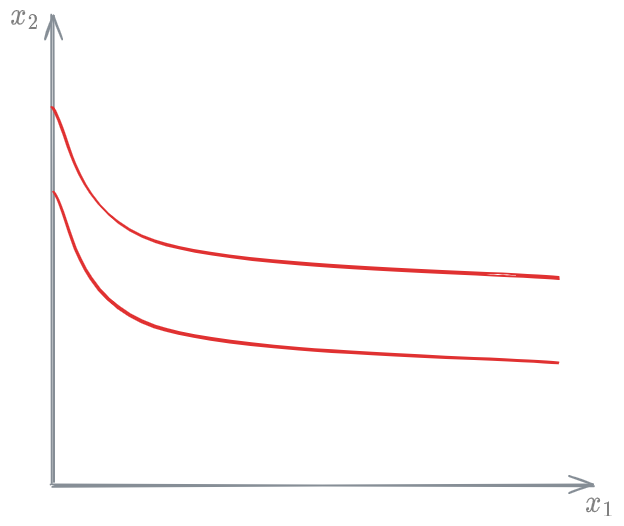

Indifference curve

The indifference curve is the locus of points

Budget constrain

Let

the total budget available Respectively the unit prices of goods 1 and 2

Then

%%

[[2024-11-13]]

%%

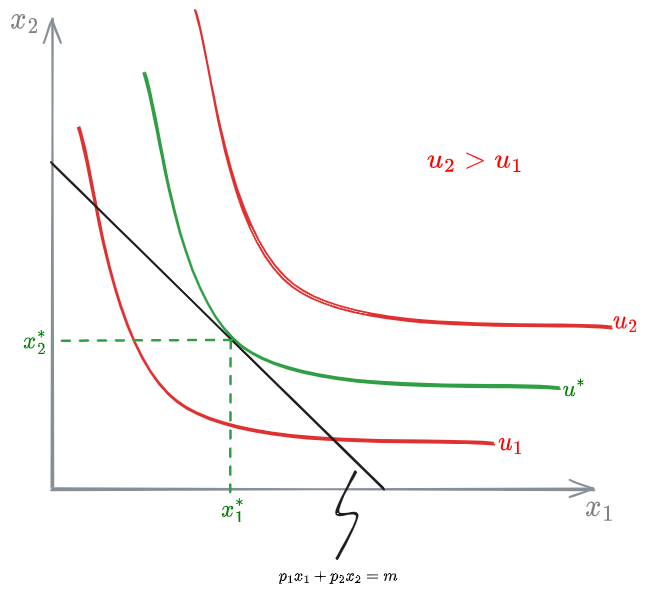

Theory of election

,

What combination

Reminding that the consumer is rational, we have an optimization problem:

subject to:

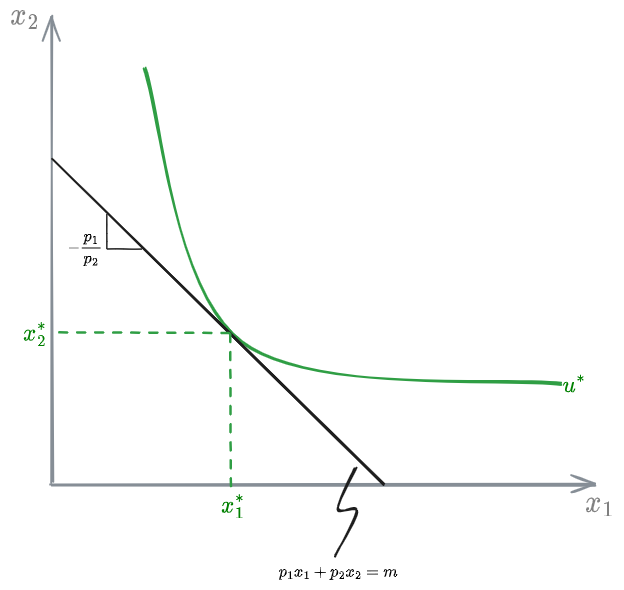

The solution to the problem is given by the utility such that the iso-utility curve is tangent to the constraint, in the tangent point:

Relation of Marginal Substitution

In order to maintain the [[#Utility function]] constant, the ratio between the production of good 1 and good 2 needs to be equal to the Relation of Marginal Substitution:

Proof:

Keeping

From this we can write:

Notice that, in the optimum point, the ratio

q.e.d.

Particular cases

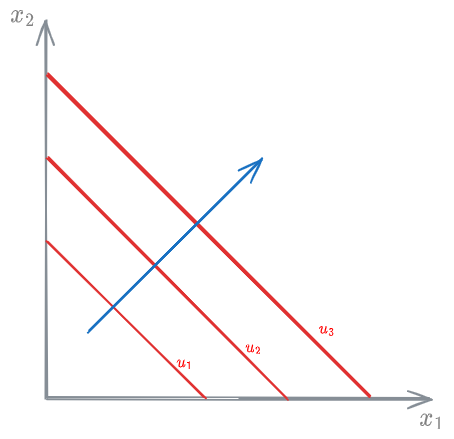

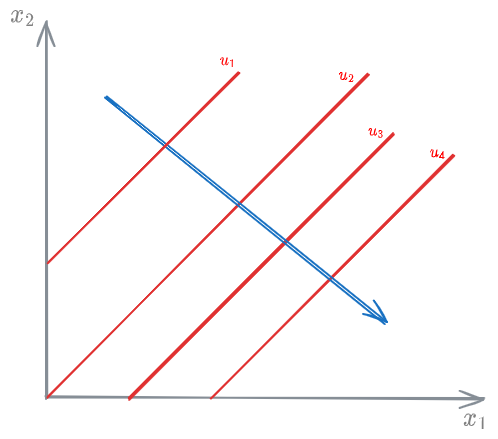

Perfectly substitutive goods

Two goods are perfectly substitutive when the consumer is willing to substitute one goods for an other with no change with a 1:1 ratio:

The arrow represents the direction in which the [[#Utility function]] increases

In this case, the utility function is well represented by a [[#Linear utility function]]

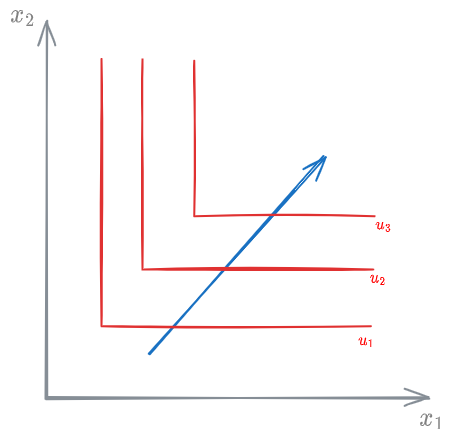

Perfectly complementary goods

Two goods are perfectly complementary if both are always consumed using fixed proportions.

The arrow represents the direction in which the [[#Utility function]] increases

In this case the [[#Utility function]] is well represented by the [[#Other utility function]].

Undesirable goods

A good is considered undesirable when the consumer does not accept it.

If

The arrow represents the direction in which the [[#Utility function]] increases

Demand function

A demand function (

where:

Demand of good Price of good Price of good different than Budget of the buyer (can be seen as costumer's income)

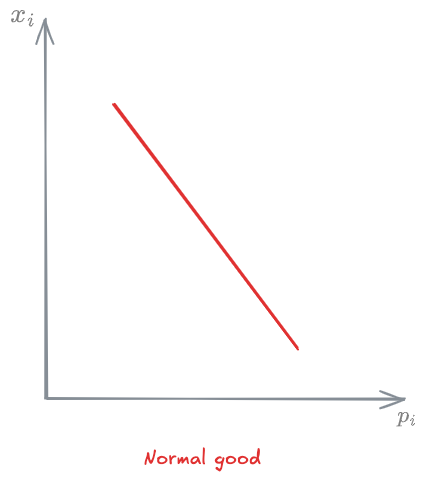

The demand has different patterns depending on the type of good:

As a function of prices, usually demand decreases as price increases

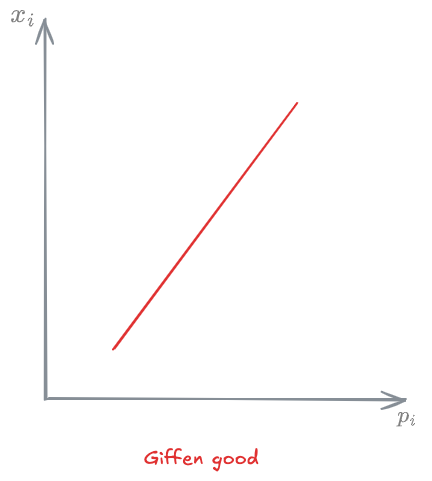

Griffen goods

Giffen goods are goods that, for some reason, have a demand that increases as price increases. This happens for example with some items during emergencies, when there is scarcity (remember face masks during covid).

Elasticity

In general, finding the [[#Demand function]] is quite difficult. Often times though, we are not really interested in knowing the full demand, but we can work at the local level. We maybe just need to know how the demand varies when changing the several factors. This introduces the concept of elasticity.

Let a demand be

Elasticity is defined as:

Elasticity is the ratio between percentage change of demand and price. It tells us how much the demand varies, for a given variation in price (see also Elasticità della domadna).

Types of elasticity

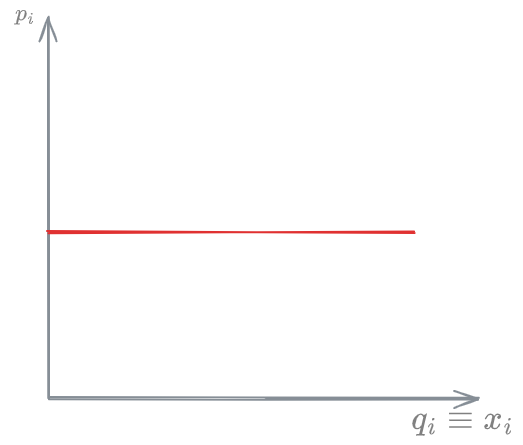

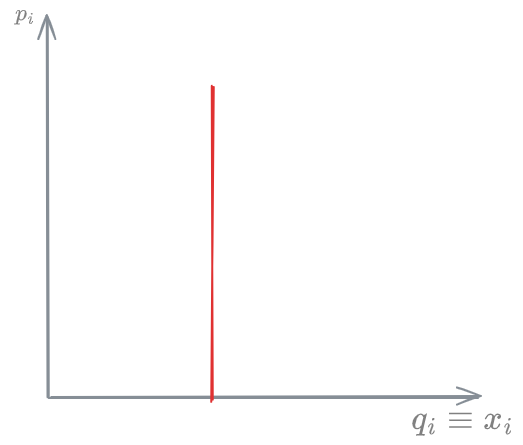

Perfectly elastic demand

A perfectly elastic demand is one where #Elasticity is infinite:

This means that, even the slightest change in price will make the demand completely different. Really, what it means is that, even keeping the price constant, makes the demand change freely.

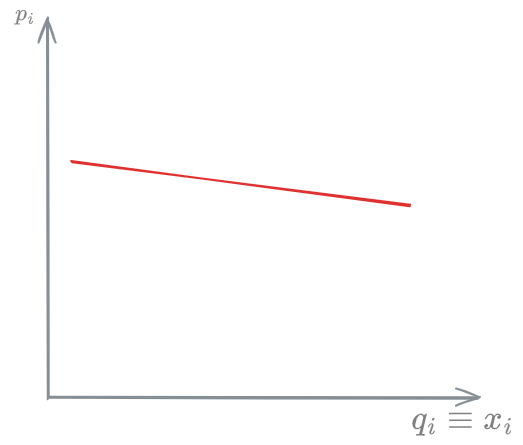

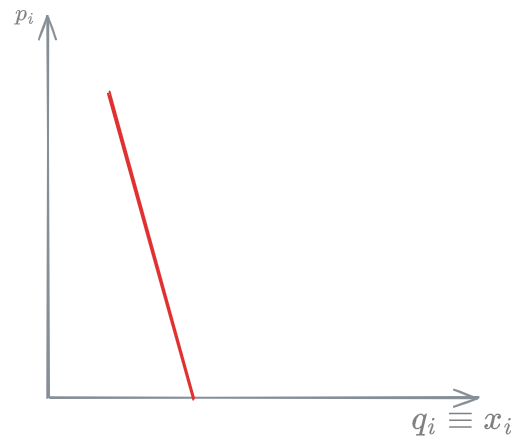

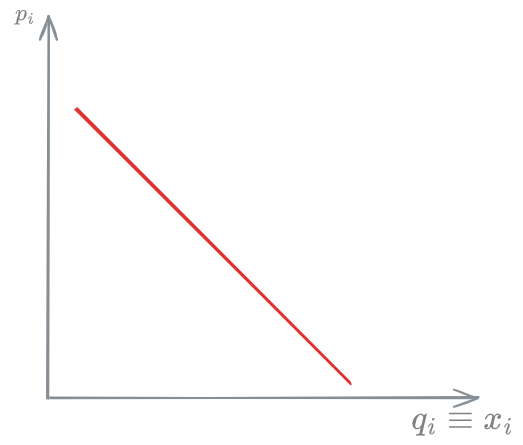

Elastic demand

An elastic demand is one where the demand is sensitive to the price. Changing the price strongly affects the demand

Perfectly inelastic demand

A perfectly inelastic demand is one where for any change in price, the demand stays constant

Inelastic demand

An inelastic demand is one where even big change in prices, only cause small changes in demand.

Unitary elasticity

A demand with unitary elasticity is one where for any percentage change in price, the demand changes of the same percentage.

Theory of pricing

Social Welfare

Social Welfare is defined as the sum of #Consumer surplus and #Producer surplus

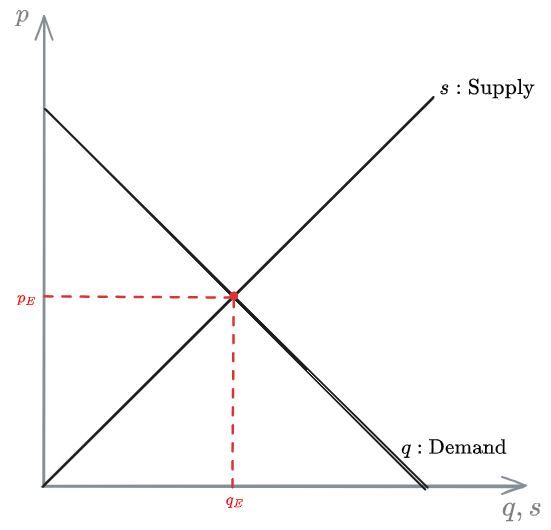

Let's imagine we have the following situation:

- A demand (

) that increases with the reducing in price - A supply (

) that increases with increase in price

The intersection of the 2 is an equilibrium point, called equilibrium price.

The equilibrium point is how much the costumer/consumer is pays in the current state of the market (with demand

Notice that, if the producer were to increase the supply, the price would increase. Same if the demand increased. This means that, in reality, the consumer is willing to pay more than

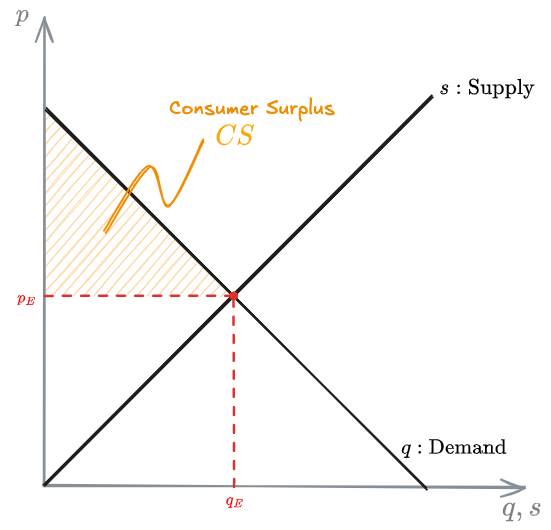

Consumer surplus

The consumer surplus is the cumulative amount that all the consumers are still willing to pay given the current market conditions. It's what they're willing to pay on top of what they're paying currently.

In the graph, the consumer suprlus can be seen as the area indicated in orange:

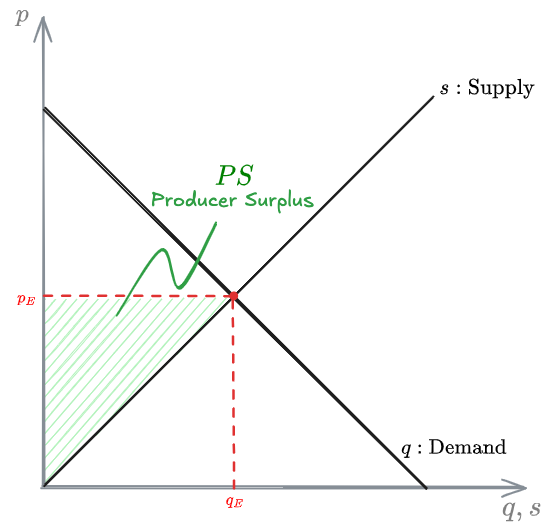

Producer surplus

The producer surplus is the amount of supply that the producer is still willing to provide.

In the graph, is the area in green

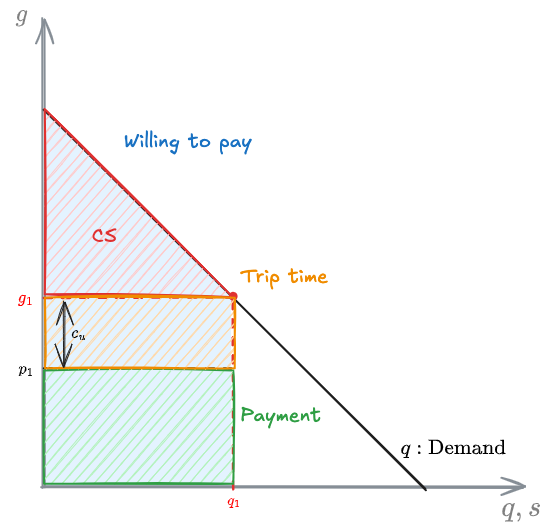

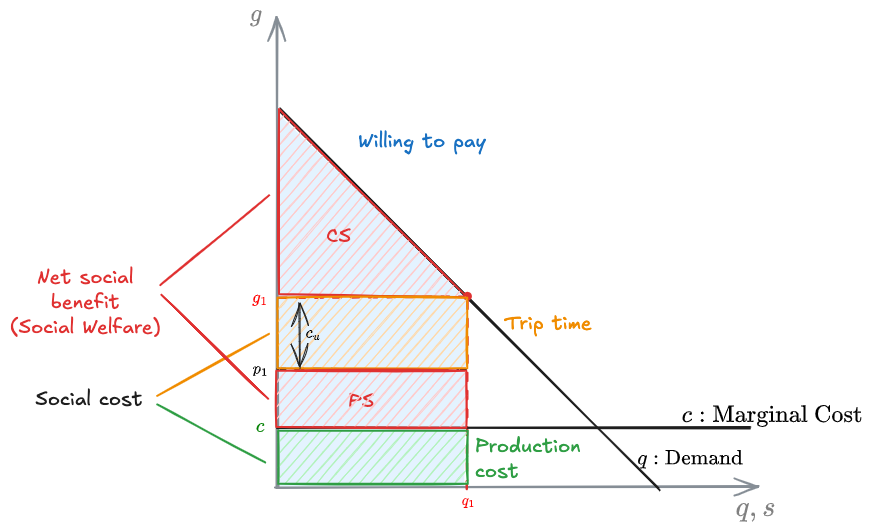

Cost, value, price

Let

where:

price cost (time) of user

From the user prospective we have:

Then, the price costumers are willing to pay at

We can then define:

#Consumer surplus:

CS = Willing to pay - cash - trip time

While, from the producer prospective:

In the graph we have:

The curve

The blue area is how much the costumers are cumulatively willing to pay.

The generalized cost for the user will be

The generalized cost for the user is the sum of the price (

If it costs the producer

The total social cost will be the sum of the orange and green areas.

While the net social benefit will be the willing to pay - social cost.

Pricing principles in transportation

Remember that the #Social Welfare is:

The Consumer Surplus is an average cost that mainly depends on the number of users (

The Producer Surplus will depend on:

Annual fix cost of the infrastructure Operating and maintenance costs Operative cost of vehicles

For simplicity:

Then, the #Producer surplus is the sum:

Maximizing the social welfare

In general, with transportation, we're interested in maximizing the #Social Welfare:

Where the SW:

This, according to what has been said before, can be written as:

where notice that, the term

To maximize this function, we calculate the first derivatives (in

Now,

And, remembering the definition of generalized cost:

we can write:

So:

❗❗❗❗❗❗❗❗❗❗❗❗

❗❗❗ COMPLETARE ❗❗❗

❗❗❗❗❗❗❗❗❗❗❗❗